Modernize

Insurance technology to

acquire new business and

expand market reach.

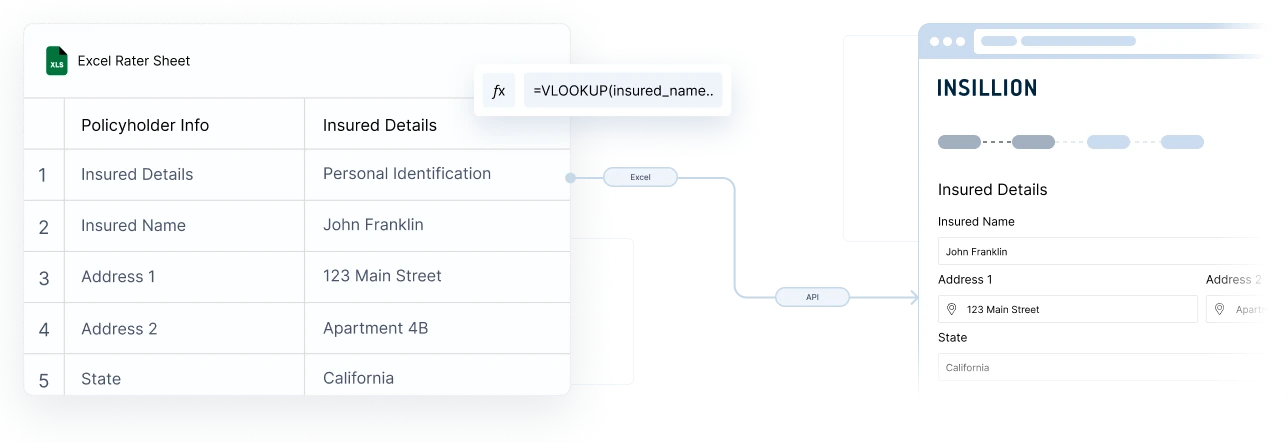

Launch new products and covers in weeks, not months,

while creating broker-friendly and customer-centric

distribution experiences.

Scale

Underwriting & Distribution

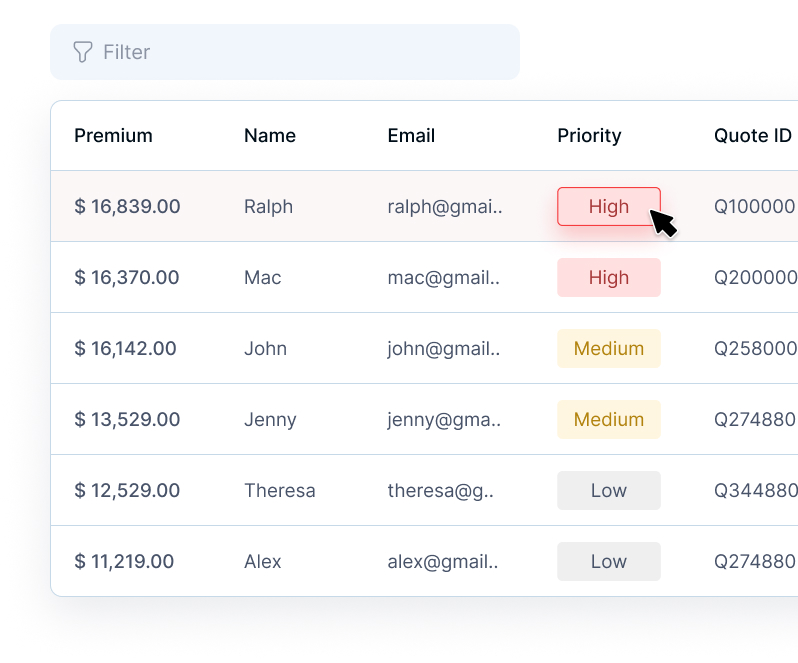

Enable agents and underwriters to foster loyal relationships with

customers through faster quotes and policy servicing.

Manage

New Product Launch & Management

Equip business, product, and IT teams, with configurable and

extendable software to manage and create insurance products with ease.

Accelerators

General, Life and Health Insurance

Accelerate speed-to-market with ready-to-use and customizable product specific templates

Cloud

Flexibility in choosing cloud and method of deployment

Case Study

Our success stories across regions

See how insurers have accelerated growth and expanded their reach with Insillion’s

scalable technology.

Frequently Asked

Questions

Questions you might ask about our products and

services.

Enterprise Grade Security for Insurance Carriers

SOC 2-certified with industry-leading practices to safeguard your data while giving IT teams complete control.