Workflow Management

AI-Powered Efficiency for Insurance Workflows

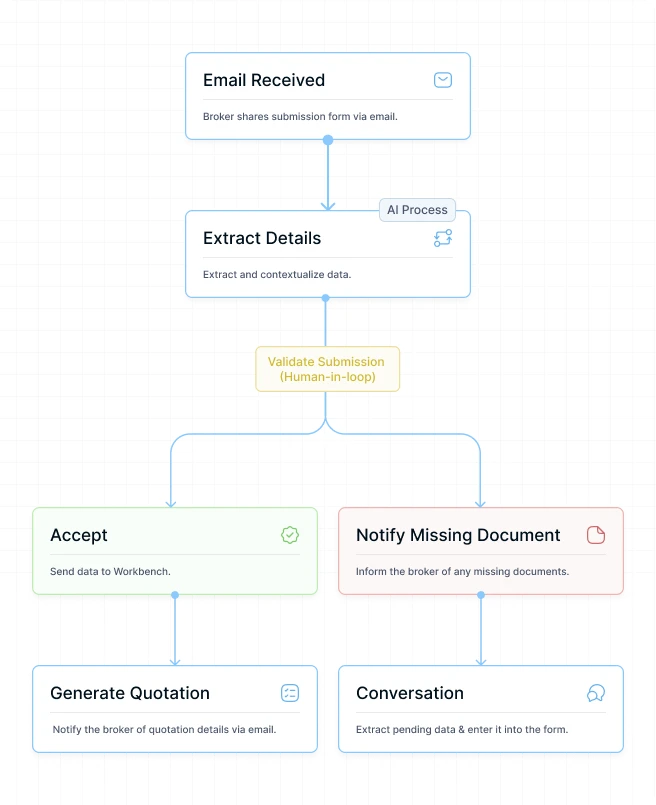

Streamline repetitive and manual tasks by automating orchestrated workflows.

Enhanced Underwriting

Best of both worlds:

Underwriting & Automation

Combine underwriting expertise with AI-driven automation

for faster and more accurate underwriting outcomes.

Business Orchestration and Automation

Workflow Automation Designed for Insurance

InFlow bridges gaps in existing processes, to reduce turnaround times for submissions and claims FNOL.

Faster turnaround

Automation to Help Insurers Focus on What Counts

AI-driven automation to enhance the insurance experience across the entire value chain.

Perspectives on Insurance Automation

What do MGAs & Carriers need to know about introducing AI into their workflows?

Our team shares practical insights on applying automation to core insurance processes.

Frequently Asked

Questions

Questions you might ask about our products and

services.