Quote to bind

Submission Automation

Augment underwriting expertise with AI, ensuring human-in-the-loop for critical underwriting workflows.

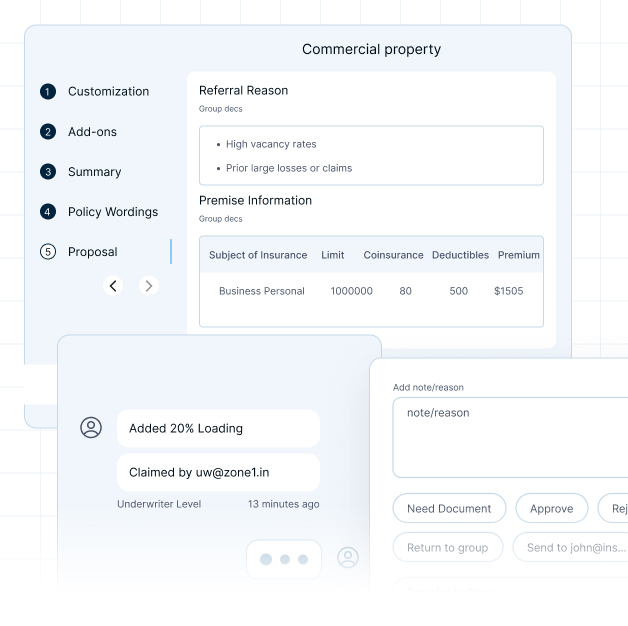

Underwring Workbench

Unify all underwriting operations into one workbench to handle even

the most complex submissions with precision and efficiency.

Underwriting Management

Risk Assessment

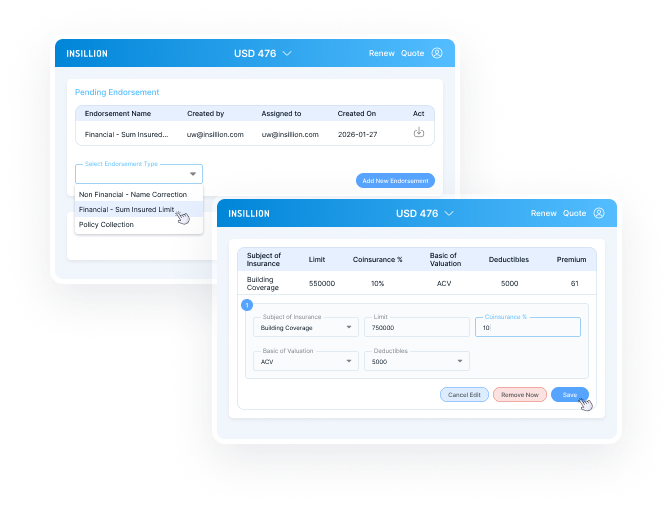

Manage end-to-end underwriting cycle for new business,

renewals, rollovers, and endorsements.

Data Partners

Integrated with risk-data providers

Recognized by industry reports

Insillion’s underwriting workbench has been featured in reports by leading consulting groups.

Frequently Asked

Questions

Questions you might ask about our products and

services.