Excel to API

Transform existing Rater-Excels into API-ready insurance

products with out-of-the-box agent and underwriter portals.

Excel to API

Transform existing Rater-Excels into API-ready insurance

products with out-of-the-box agent and underwriter portals.

Spreadsheet to GTM

Create Product APIs from Rater-Excels

Convert business and premium computation logic present in Rater-Excels into APIs that integrate with existing

systems to avoid recreation of logic across multiple systems.

Rapid Launch

Quickly create product APIs and

distribution portals using

existing Rater-Excels.

Integration APIs

Build an API layer for existing

systems to externalize rating

logic and enable connectivity.

Version Management

Update rating logic by uploading

revised Rater-Excel with all

versions linked to issued

policies.

Digital Distribution

Product APIs for distribution

partners and embedded

journeys to maintaining a single

source of truth for rating logic.

Rapid Launch

Create and Launch Insurance

Products, Fast

Overcome the challenge of knowledge transfer between

multiple teams for product development by leveraging the

underwriting team’s proficiency in developing logic in Excel.

Accelerated speed to market

Bring products to market and new channels quickly without spending resources on recreating and maintaining business logic across systems.

Align Business and IT Teams

Business teams can focus on product management with familiar tools, while IT teams extend these products to partners with APIs.

Utilize existing resources

Excel’s low learning curve makes it easier for underwriting/business teams to control the product development and iteration process.

Product Management

Bridge Business and IT Collaboration

Bring together underwriting expertise and IT teams for shortened development timelines.

Quote-to-bind API

Generation, Javascript, Swagger

API Documentation are available

as output for IT teams.

300+ Excel formulae

over 300 Excel formulae to set

up insurance products.

Rate Impact Testing

logic, analyze rate impacts, and

optimize calculations across versions.

Form Generation

Word Documents to generate

forms without any programming.

Frequently Asked

Questions

Questions you might ask about our products and

services.

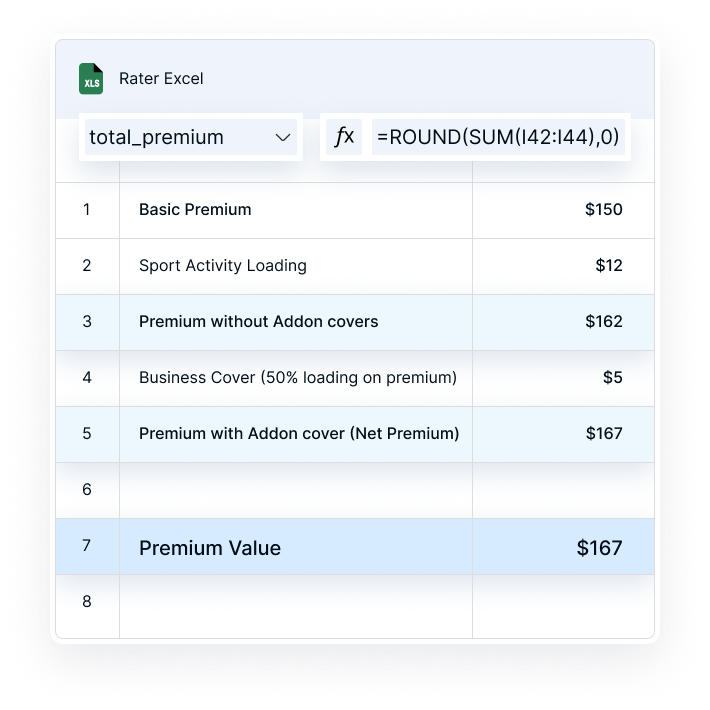

Insillion uses insurers’ existing Rater-Excel to simplify product creation. The platform uses Excel files as the source for rating logic and rate tables. Inputs and outputs are named within the file, allowing mapping through Insillion. This setup lets business users manage rating and rule configurations without any coding.

Insillion converts Excel-based rating models into ready-to-use APIs without coding, allowing insurers to launch products in days. Traditional implementations often involve lengthy build cycles, handoffs between business and IT, and constant back-and-forth for changes. With Insillion, underwriters retain ownership of the rating logic in Excel, while IT teams integrate via the generated APIs. These APIs, along with ready-to-use portals, cut long implementation cycles and enable faster distribution.

Insillion’s Excel-to-API converter maintains a single source of truth by converting the business and premium computation logic from Rater-Excels into centralized, versioned APIs. Once uploaded and integrated, all frontend and backend systems access rating results through the same API. This eliminates the need to recreate logic across multiple systems and ensures consistent rating outcomes.

Underwriters are comfortable developing premium logic in Excel and the transfer of knowledge to other teams can often be a challenge, since there are frequent changes from different stakeholders. The time and efforts spent in developing and re-developing the products can cause a ROI burn when the cost of launching the product is greater than the ROI gained from launching the product itself. Hence, Insillion helps carriers and MGAs overcome development costs by utilizing existing Rater-Excels to launch products.

Platforms suited for automating insurance rating engines from Excel are those with Excel-to-API capabilities, such as Insillion. These platforms convert the rating logic within an Excel file into scalable APIs that can be consumed by internal and partner systems. By automating this conversion, insurance providers can speed up product creation and avoid the difficulties of writing complex code for insurance products.