Rating

Empower business and underwriting teams to manage rates

using low-code tools and Excel.

Rating Engine

Real-time enterprise rating for insurers

Build and adjust insurance products quickly to keep pace with market demands.

Market responsive

Make rate changes while maintaining IT

governance with maker-checker models.

Existing Resources

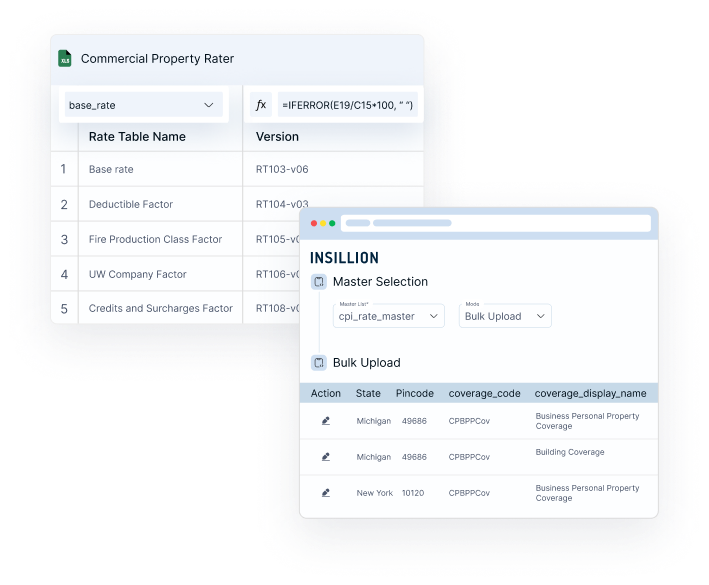

Utilize existing Rater and Actuarial Excel to

build a flexible rating engine.

Decoupled Rating

Externalize rating as a standalone

microservice, allowing adjustments without

impacting core systems.

Approaches to Rating

Customize rate management approach based on existing

systems and the needs of business and underwriting teams.

Rater to Rating API

Create new products by converting premium and rating logic present in

Rater Excels into APIs to be consumed by existing and external systems.

Existing BREs

Integrate portals generated by Insillion or third-party partners with existing Business Rule Engines for rating and premium calculations.

Third-Party Rating Services

Integrate with external rating services such as ISO, and AAIS to enrich underwriting processes.

Low code rating software

Rate management

Advanced tools for IT and business teams to manage rates efficiently.

Configurator

Accept submissions and FNOL via email,

portals, or API integrations.

Versioning

Rater-Excels linked to in-force policies

Rate Modifiers

Construct referral triggers using a mix of or

only Excel-logic and complex code

Test Environments

Trial and test new rate-books before

deployments.

Scale

High availability architecture based on CAT

events

Referral Triggers

Construct referral triggers using a mix of or

only Excel-logic and complex code

Rating Solutions

Industry-Specific Solutions

Product-based rating templates for faster product launches and updates.

Life Insurance

Convert Rater-Excels into Benefit Illustration

calculation APIs to share with distribution

partners.

Commercial Lines

Give business teams control over master data,

validations, and referrals with low-code

configuration.

Health Insurance

Prefill and enrich rating parameters using

integrated third-party data for more precise

underwriting.

Frequently Asked

Questions

Questions you might ask about our products and

services.

Insillion automatically converts the premium logic and rate tables from uploaded Rater-Excels into a RESTful API. Internal portals, partner systems, or existing core systems can then consume these APIs.

When a Rater Excel is uploaded, Insillion converts its logic into JavaScript code used by the rating engine for real-time calculations. The original Excel is no longer executed at runtime. Once the code is generated, the system maintains traceability to the source of Excel but executes only the transformed logic.

Every time a Rater‑Excel is uploaded, Insillion versions it. Each version is linked to in‑force policies, captures inputs, outputs, and rating logic, and supports rollback or comparison ensuring full traceability and governance.

By externalizing their rating in a separate insurance rating engine, insurers can easily make changes to rates and test them against their existing book of business using UI-based configuration. This approach reduces the need for custom code or specialized resources. For commercial lines, they can also integrate with Business Rule Engines (BREs) to maintain master data, which simplifies the process of changing rates.

Yes, a flexible insurance rating engine allows insurers to define rates at an extremely granular level. For example, with Insillion’s insurance rating engine, commercial property insurers can define rates and rate modifiers at the national, state, zip code, and zone levels.

Insurers and MGAs have three different approaches to rating within Insillion. First, for products with minimal rate changes, the logic can be contained within the Rater-Excel itself. Second, for products with more dynamic changes, rates are maintained using Insillion’s insurance rating engine. Third, for products that rely on external logic, insurers can integrate with third-party rating systems via APIs.