Table of Contents

Insurance Underwriting Orchestration Software

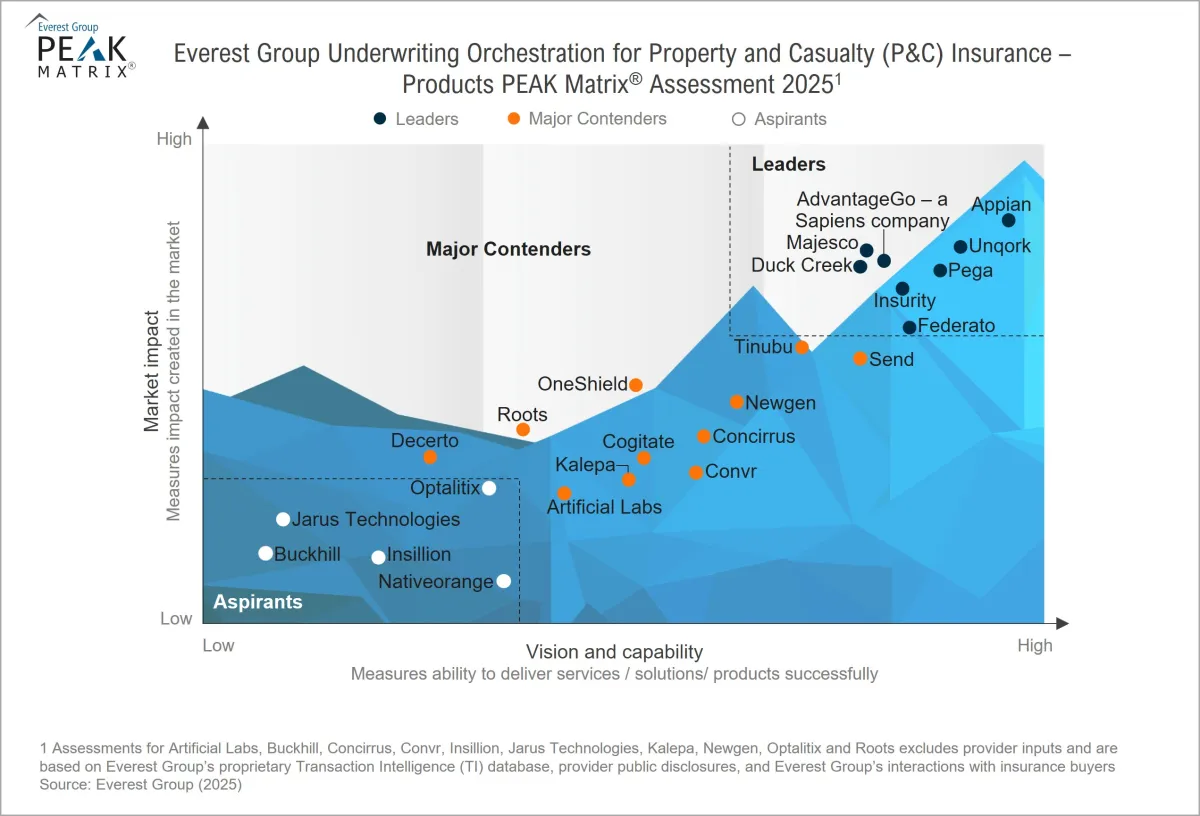

The Underwriting Orchestration for P&C Insurance – Products PEAK Matrix® Assessment 2025 by Everest Group is a comprehensive evaluation of technology platforms that enable insurers to transform their underwriting operations.

Across commercial and personal lines, underwriters spend over 41%-43% of their time on administrative work, compared to just 32–33% on core underwriting, highlighting a clear opportunity for automation and orchestration to rebalance effort toward higher-value decisions. Carriers will be looking to consolidate existing systems, create frictionless experiences, and optimize costs. The availability of fit-for-purpose solutions (e.g., underwriting workbench platforms, policy administration systems) is making modernization somewhat easier.

The report analyzes how vendors support end-to-end automation from submission intake and data enrichment to decision intelligence and underwriting workbenches. Automated quoting has driven large efficiency gains for large carriers and brokers alike. Centralized commercial insurance underwriting software, or workbenches, provides underwriters with everything they need in one place, integrated workflows for data collection, risk evaluation, pricing, portfolio insights, policy issuance, and documentation generation.

Industry trends highlighted in the Everest Report

Everest Group identifies several major trends shaping the future of underwriting technology:

- Intelligent Submission Intake

- Automated Appetite & Eligibility Checks

- AI-Assisted Risk Insights

- Portfolio Visibility & Guardrails

- Shift to Enterprise Automation Platforms

The Top 5 Barriers to Underwriting Automation Adoption

Even though underwriting automation has matured significantly, many insurers still hesitate to adopt it.

- Cost Concerns

Many insurers assume underwriting automation requires a heavy upfront investment in software licenses, IT support, staff training, and ongoing updates. Automation should be viewed as an efficiency investment, not a technology expense. The long-term savings from reduced manual work, faster underwriting cycles, and improved submission quality typically far exceed the initial cost.

2. Time to Implement

Many insurers fear that implementing an automated underwriting system will take months they cannot afford to lose. With lean teams and increasing underwriting workloads, change may feel disruptive. Modern underwriting automation simply requires clear application processes and product rules, enabling faster decisions, fewer repetitive tasks, and greater underwriting capacity.

3. IT Complexity & Integration

Insurers often worry that new underwriting platforms won't fit into their current IT ecosystem, especially when they have standard insurance systems. Modern cloud-based insurance underwriting orchestration software integrates seamlessly with IT, letting business users manage workflows while IT focuses on strategic priorities.

4. Scale & Scope

Insurers often assume that automation must solve every underwriting scenario before adoption. This creates delayed decision-making and slows innovation. Finding a platform to handle every edge case can feel overwhelming when the real priority is automating high-volume, routine scenarios that deliver the most impact.

5. Apprehension & Resistance to Change

Teams often fear that automation will replace jobs or reduce the value of underwriters. Others believe automated systems may miss suspicious or fraudulent submissions. Automation acts as a productivity tool by handling routine submissions, freeing underwriters to focus on complex decisions while improving transparency.

How Insillion's Underwriting Suite Stands Out

Insillion's commercial insurance underwriting software exemplifies the market trends identified as "Aspirant" in the Everest Group PEAK Matrix report.

- AI-driven Automation across Ingestion and Enrichment: Insillion's insurance underwriting workbench uses intelligent document processing and API-driven data enrichment to automatically capture and structure submission details from broker documents and external sources, freeing underwriters to focus on risk evaluation and decisioning.

- Scalable Integration: Built on a flexible, API-first architecture, Insillion integrates seamlessly with existing third-party data sources, policy administration systems, rating engines, and broker portals to streamline core underwriting, rating, and distribution processes.

- Configurable Workbenches tailored to diverse LOB: Insillion's low-code underwriting workbench platform lets teams configure workflows, rules, and triage logic to match the unique needs of different products, channels, and underwriting models without coding.

- Strong Accelerators for Specialty and MGA Segments: With modular tools designed for rapid product launches, straight-through processing, and flexible workflow configurations, Insillion empowers carriers, MGAs, and specialty teams to scale efficiently and serve niche markets with precision.

- 180-day Sandbox and Pay-as-you-grow: MGAs can start to build insurance products from spreadsheets and later test and scale platform costs as premium volume grows. Insillion offers flexible plans tailored for both startup MGAs and enterprise MGAs, allowing you to choose the option that fits your business stage.

Insillion's inclusion in this industry assessment highlights its ability to support the evolving needs of MGAs and carriers, enabling rapid product launch, streamlined underwriting workflows, and scalable automation without heavy operational overhead.

Articles

Recent Articles

Loading recent posts...

Stay updated on

what’s relevant