Table of Contents

- What is meant by insurance penetration?

- How much is the insurance penetration in India?

- How much is the premium density in India?

- Life insurance penetration in India

- General insurance penetration in India

- What is the growth rate of insurance industry in India?

- Insurance Penetration Challenges in India

- Low Awareness and Financial Literacy

- High Distribution Costs and Limited Accessibility

- Affordability Constraints and Misaligned Product Offerings

- Claims Settlement and Trust Deficit

- Limited Risk Capacity and Reinsurance Support

- Conclusion

- Author Details

June 28 is celebrated as Insurance Awareness Day across the globe to highlight the protection gap in vulnerable communities and drive conversations about insurance penetration through product innovation and regulatory efforts. This thought leadership is the first part of a discussion that explores the current state of insurance penetration in India and the challenges that lie ahead.

What is meant by insurance penetration?

Insurance penetration, a critical indicator of the insurance sector’s contribution to the overall economy, is defined as the ratio of total insurance premiums (life and non-life) to Gross Domestic Product (GDP). It is a vital metric indicating the role of insurance in a country’s economy. It reflects the extent to which the population is covered by insurance. In a developing country like India with a vast population, expanding middle class, and increasing risk awareness, insurance has a vital role in promoting economic stability, financial inclusion, and social security. For a country like India, which faces wide income disparities, low social security coverage, and increasing exposure to natural and man-made risks, insurance is a crucial tool for financial resilience.

Despite its enormous potential, India has historically lagged behind global averages in terms of insurance penetration. However, the last two decades have seen significant developments in the sector, fueled by liberalization, regulatory reforms, digital transformation, and the emergence of insurtech players.

How much is the insurance penetration in India?

As per the IRDAI Annual Report (2022–23) and Swiss Re Sigma Report (2023),India’s overall insurance penetration stood at 4.2% of GDP.

- Life insurance: 3.2%

- Non-life insurance: 1.0%

In comparison, the global average is 7.0%, and for developed economies like the UK (11.1%) and the USA (11.3%), is significantly higher. Among Asian peers:

- China: 4.7%

- South Korea: 11.6%

- Japan: 8.3%

India ranked 10th globally in terms of total insurance premium volume (life + non-life), but the country ranked much lower in per capita premium (premium density).

How much is the premium density in India?

Premium density measures the per capita insurance premium in USD terms:

- Life insurance premium density (India, 2022): USD 59

- Non-life insurance premium density: USD 19

- Global average- Life: USD 391

- Global average -Non-life: USD 379

- Peer comparison:

- China: Life – USD 270; Non-life – USD 115

- Brazil: Life – USD 170; Non-life – USD 150

This clearly reflects a significant underinsurance among Indian individuals and businesses, especially in rural and informal sectors.

Life insurance penetration in India

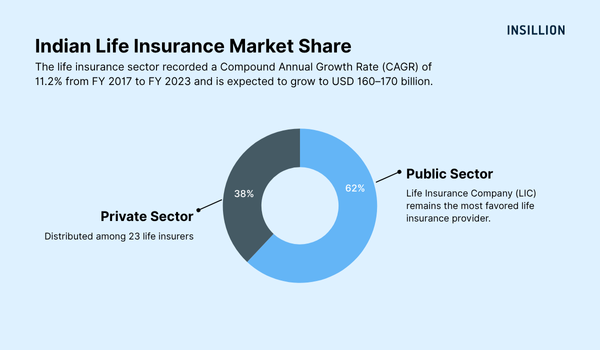

India's life insurance sector remains heavily skewed in favor of the state-owned Life Insurance Corporation of India (LIC), which continues to command a dominant position in the market. As of FY 2022–23, LIC accounted for approximately 62% of the market share in first-year premium collections, a decline from its earlier monopolistic stature but still a reflection of its deep distribution network and high consumer trust. The remaining 38% is distributed among 23 private life insurers, with key players such as HDFC Life, SBI Life, ICICI Prudential Life, and Max Life emerging as competitive forces through focused bancassurance partnerships, digital onboarding, and product innovation.

Private insurers have steadily gained traction by targeting affluent urban customers with differentiated products such as

- Unit Linked Insurance Plans (ULIPs)

- Retirement savings plans

- Term insurance with riders

- Digitally underwritten health-linked life covers.

They have also improved underwriting efficiency and customer engagement using AI-based risk scoring and data analytics, helping to reduce turnaround time in policy issuance and claim settlement.

Moreover, there is a visible shift in the composition of life insurance premiums from traditional endowment products to pure protection products, such as term insurance, especially post-pandemic. However, the overall protection gap remains wide, with Swiss Re estimating India’s mortality protection gap at over USD 16 trillion.

General insurance penetration in India

The non-life insurance industry in India is far more fragmented, with 31 active players, including four public sector insurers, private insurers like ICICI Lombard and HDFC ERGO, standalone health insurers (e.g., Star Health, Niva Bupa), and a small number of specialized players. The gross direct premium income (GDPI) of the general insurance industry reached approximately INR 2.57 lakh crore in FY 2022–23, showing strong annual growth supported by both retail and commercial demand.

The product composition in the general insurance space remains highly concentrated:

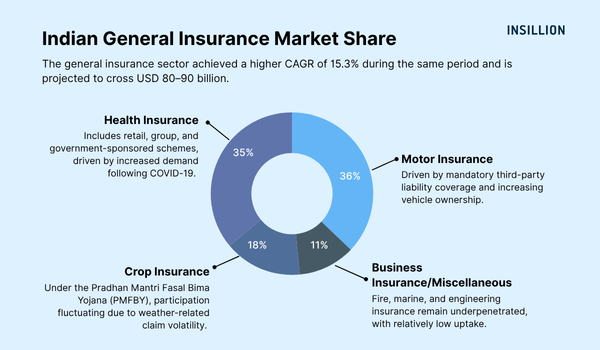

- Motor insurance contributes around 36% of GDPI, driven by mandatory third-party liability coverage and increasing vehicle ownership, although the recent economic slowdown and EV transition have moderated growth in new business.

- Health insurance, including retail, group, and government-sponsored schemes—accounts for around 35% of the total, witnessing robust demand due to heightened health risk awareness post-COVID-19.

- Crop insurance, primarily under the Pradhan Mantri Fasal Bima Yojana (PMFBY), contributes about 18%, with participation fluctuating due to state-level policy shifts, premium burden on farmers, and weather-related claim volatility.

In contrast, fire, marine, and engineering insurance remain underpenetrated, with relatively low uptake among MSMEs and infrastructure sectors. Liability and cyber insurance lines are in nascent stages, with awareness and underwriting data still evolving.

What is the growth rate of insurance industry in India?

India’s insurance sector has displayed robust expansion over the last few years, with both life and non-life segments growing faster than the GDP.

- The life insurance sector recorded a Compound Annual Growth Rate (CAGR) of 11.2% from FY 2017 to FY 2023 and is expected to grow to USD 160–170 billion, buoyed by demographic shifts, tax incentives under Section 80C and 10(10D), and increased retail financial literacy.

- The general insurance sector achieved a higher CAGR of 15.3% during the same period and is projected to cross USD 80–90 billion, supported by SME-focused products, rising healthcare costs, growing vehicular base, and government subsidies for agriculture and health insurance.

According to industry estimates (e.g., IBEF and Deloitte), the total Indian insurance market size is projected to reach USD 250 billion by 2027, up from approximately USD 150 billion in 2023. This trajectory reflects both a deepening of insurance penetration and a broadening of product portfolios, underpinned by regulatory liberalization, improved data availability, and rising insurtech participation.

Insurance Penetration Challenges in India

Despite ongoing regulatory reforms and an expanding market, India’s insurance penetration remains relatively low due to a confluence of structural, economic, and behavioral barriers. These challenges hinder the expansion of insurance coverage across underserved populations and underinsured sectors.

Low Awareness and Financial Literacy

Insurance, being an intangible and deferred benefit product, requires a foundational understanding of financial concepts to be perceived as valuable. However, according to the National Council of Applied Economic Research (NCAER),

- Only 23% of Indian adults demonstrate a basic understanding of insurance products, including concepts such as premium, sum assured, policy tenure, and exclusions.

- In rural and semi-urban areas, this gap is even wider where insurance literacy drops below 15%, despite these regions being more vulnerable to health shocks, agricultural losses, and climate-related risks.

This lack of awareness leads to underinsurance, policy lapses, and misinformed purchase decisions, especially in the life and health segments. The absence of structured financial education in schools and workplaces, coupled with limited access to unbiased advisory services, exacerbates the situation.

High Distribution Costs and Limited Accessibility

India’s insurance distribution model remains heavily dependent on physical intermediaries, such as agents, corporate agents, and brokers.

- Over 92% of agents are concentrated in Tier 1 and Tier 2 cities, creating an urban-centric distribution bias.

- Less than 20% of Indian villages have access to any formal insurance channel, despite being home to nearly two-thirds of the population.

High acquisition and servicing costs in low-ticket-size segments discourage insurers from aggressively pursuing rural and informal sector business. Traditional agency channels lack scalability in remote areas due to logistical constraints, low commission viability, and limited digital adoption among last-mile users.

Affordability Constraints and Misaligned Product Offerings

Economic constraints severely limit the affordability of comprehensive insurance in low-income segments.

- Average monthly rural household income ranging between ₹8,000–₹10,000, even a modest annual health or term life premium becomes a financial burden.

- While government-sponsored schemes offer basic coverage, they often lack sufficient benefit limits and comprehensive features.

Furthermore, insurance products are often designed with urban consumers in mind, failing to address the unique risk profiles and preferences of rural and small business segments, resulting in product-market misalignment, reflected in poor renewal ratios and persistency.

- Less than 18% of India’s MSMEs, which contribute about 30% to GDP, have property, liability, or business interruption coverage, despite being highly vulnerable to physical, legal, and cyber risks.

Claims Settlement and Trust Deficit

Trust in the insurance system is influenced heavily by the transparency and timeliness of claims settlement.

- Life insurance sector maintains relatively high settlement ratios, LIC at 98.7% and private insurers averaging 96.4% (FY 2022–23), while delays, documentation burdens, and repudiation remain common grievances.

- General insurance sector has a claim repudiation ratio that hovers around 6.5%, with higher figures in motor and health insurance, often due to misrepresentation, non-disclosure, or inadequate documentation.

These issues result in widespread consumer distrust, further discouraging policy purchases or renewals. The lack of efficient grievance redressal systems and slow adoption of AI-based fraud detection also contribute to these inefficiencies.

Limited Risk Capacity and Reinsurance Support

India’s reinsurance landscape is dominated by the domestic reinsurer, GIC Re, which accounts for over 50% of ceded reinsurance premium from Indian insurers. While this enables national risk retention and capacity development, the absence of diversified and deep international reinsurance support limits risk appetite, especially for catastrophe-prone lines like agriculture, property, and liability.

With the increasing frequency and severity of natural catastrophes (floods, cyclones, earthquakes), reinsurers have adopted a cautious approach, resulting in capacity tightening and higher pricing, particularly for proportional treaties and catastrophe-exposed lines. This impacts insurers' ability to innovate, expand coverage limits, or offer affordable pricing in underinsured sectors.

Conclusion

Despite recent progress, India remains significantly underinsured when compared to its economic potential and demographic size. While insurance penetration has improved marginally, large disparities exist across regions, income groups, and product lines. The future of the insurance industry in India lies in targeted product innovation, technology integration, and inclusive distribution strategies. Continuing this discussion, CA Chandrasekaran Ramakrishnan has outlined the way forward for the Regulator and Insurers to drive insurance penetration and close the protection gap in the second part of this thought leadership.

Articles

Recent Articles

Loading recent posts...